Budgeting 101: A Simple Guide to Saving Big with Deposit Manager

Are you ready to take control of your finances and start saving big? Budgeting is the key to financial success, and when combined with the powerful tools of Deposit Manager, you can achieve your savings goals faster than you ever imagined. In this comprehensive guide, we'll walk you through the basics of budgeting and show you how to supercharge your savings with Deposit Manager.

The Importance of Budgeting

Budgeting is the foundation of financial stability. It's the process of tracking your income and expenses to ensure that you're living within your means. A well-planned budget not only helps you cover your bills but also allows you to allocate funds for savings, investments, and achieving your financial goals.

Whether you're looking to build an emergency fund, save for a dream vacation, or plan for retirement, budgeting is the first step towards making your financial dreams a reality.

Creating Your Budget

Creating a budget doesn't have to be daunting. Start by listing your sources of income and your monthly expenses. Be thorough and include all your regular bills, groceries, transportation, and discretionary spending.

Next, compare your total income to your total expenses. The goal is to have a surplus, which you can allocate towards savings and investments. If you find that your expenses exceed your income, it's time to identify areas where you can cut back.

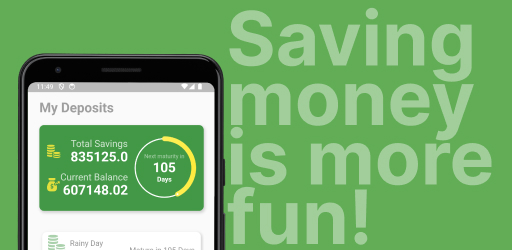

Supercharge Your Savings with Deposit Manager

Deposit Manager is your secret weapon for turbocharging your savings. With its user-friendly interface and powerful features, it's the ideal tool for anyone looking to save big.

Daily Interest Calculation

One of Deposit Manager's standout features is its ability to calculate interest on your savings daily. This means that your money is constantly working for you, generating more income than with traditional savings accounts. You can see your savings grow in real-time, providing motivation to save more and reach your goals faster.

Due Date Reminders

Missed due dates for fixed deposits are a thing of the past with Deposit Manager. The app sends you timely reminders, ensuring that you never miss an opportunity to maximize your savings. These reminders give you ample time to prepare for your next deposit or withdrawal, helping you stay on track with your financial plan.

Secure and Private

We understand the importance of financial privacy. Rest assured, Deposit Manager keeps all your financial data offline, ensuring your information remains completely private and secure. Your sensitive data is stored locally on your device, providing you with peace of mind.

Creating a Savings Habit

Budgeting and saving money are essential habits for financial success. Deposit Manager not only helps you save efficiently but also encourages the habit of saving consistently. By setting achievable savings goals and tracking your progress, you'll find it easier than ever to make saving a part of your daily life.

Start Saving Big Today

Now that you have a clear understanding of budgeting and the incredible benefits of Deposit Manager, it's time to take action. Start by creating your budget, identifying areas to save, and setting achievable goals. Then, let Deposit Manager be your partner on your savings journey.

With Deposit Manager, saving big becomes a reality, and your financial dreams are within reach. Take the first step today and watch your savings grow like never before.

Tags: budgeting, saving money, saving more, deposit manager, deposit calculator