Emergency Funds: How to Build One and Keep It Safe with Deposit Manager

In an unpredictable world, having a financial safety net is crucial. Emergency funds provide the stability you need when unexpected expenses arise. In this comprehensive guide, we'll explore how to build and safeguard your emergency fund while using Deposit Manager as your trusted tool.

The Importance of Emergency Funds

Emergency funds act as a financial lifeline during challenging times. They shield you from the stress of unexpected medical bills, car repairs, or sudden job loss. This financial cushion prevents you from relying on credit cards or loans, which can lead to debt spirals.

Having a well-funded emergency fund ensures that you have the peace of mind to tackle unexpected expenses without derailing your financial goals.

Setting Your Emergency Fund Goal

The first step in building an emergency fund is determining how much you need. Calculate your ideal emergency fund size based on your monthly expenses, potential emergencies, and your financial goals. This personalized approach ensures you have the right safety net for your unique situation.

Building Your Emergency Fund

Building an emergency fund takes time and discipline. We'll provide strategies for saving consistently, including budgeting, setting up automated transfers, and establishing achievable milestones. You'll learn how to prioritize your emergency fund alongside other financial goals.

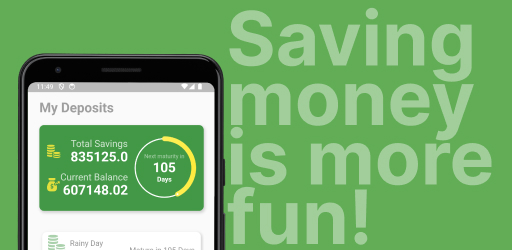

Deposit Manager, with its daily interest calculations and due date reminders, can play a pivotal role in your savings journey. It allows you to monitor your progress and stay on track.

Why Deposit Manager Is Your Trusted Ally

Deposit Manager is a valuable companion in your quest to build a robust emergency fund. It simplifies the process of tracking your savings and ensuring your money works for you. Its real-time calculations make it easier to visualize your progress and stay motivated.

Keeping Your Emergency Fund Safe

We understand that the security of your emergency fund is paramount. Deposit Manager takes data privacy seriously, keeping your financial information offline and secure. Additionally, you can explore options like high-yield savings accounts for safeguarding your fund while earning interest.

The Habit of Saving: A Lifelong Skill

Building an emergency fund is just one aspect of a broader financial skill: the habit of saving. Deposit Manager can help you cultivate this vital habit by making it easy to save consistently and see the rewards of your efforts.

Remember that financial stability is an ongoing journey. With Deposit Manager by your side, you can navigate the unexpected with confidence and build a secure future for yourself and your loved ones.

Tags: deposit calculator, saving money, how to make a habit of saving